prodat-mashinu-srochno.site Market

Market

What Can Be Deducted From Taxes For Self Employed

Tuition, books, supplies, transportation and more may all be deductible if you're self-employed. The IRS provides a work-related education tool to help you. If you're self-employed, you may deduct on Form 1 (Line 11) or Form 1-NR/PY Self-Employment Tax, that you paid during the taxable year. For. You can deduct the employer-equivalent portion of your self-employment tax in figuring your adjusted gross income. This deduction only affects your income tax. Self-Employment Tax Deduction. Everyone has to pay into Social Security and Medicare from their income. With an employer, the company will pay for half while. Self-Employment (NEC, MISC, Schedule SE) · Payment Processing (K) · Business Profits and Losses (Schedule C) · Rental Income (Schedule E) · Home. For self-employed individuals, rent and lease payments can often be written off as business expenses. This means that these costs can be deducted from your. You can deduct part of the self-employment tax you paid as an adjustment to income. So, you can claim the deduction even if you don't itemize deductions. Claim. A tax deduction is something you can deduct or subtract from your taxable income. It lowers the amount of income you're taxed on and helps save you from paying. Many freelancers may qualify for a deduction of up to 20% for qualified business income. In addition, contributions to certain retirement accounts may also be. Tuition, books, supplies, transportation and more may all be deductible if you're self-employed. The IRS provides a work-related education tool to help you. If you're self-employed, you may deduct on Form 1 (Line 11) or Form 1-NR/PY Self-Employment Tax, that you paid during the taxable year. For. You can deduct the employer-equivalent portion of your self-employment tax in figuring your adjusted gross income. This deduction only affects your income tax. Self-Employment Tax Deduction. Everyone has to pay into Social Security and Medicare from their income. With an employer, the company will pay for half while. Self-Employment (NEC, MISC, Schedule SE) · Payment Processing (K) · Business Profits and Losses (Schedule C) · Rental Income (Schedule E) · Home. For self-employed individuals, rent and lease payments can often be written off as business expenses. This means that these costs can be deducted from your. You can deduct part of the self-employment tax you paid as an adjustment to income. So, you can claim the deduction even if you don't itemize deductions. Claim. A tax deduction is something you can deduct or subtract from your taxable income. It lowers the amount of income you're taxed on and helps save you from paying. Many freelancers may qualify for a deduction of up to 20% for qualified business income. In addition, contributions to certain retirement accounts may also be.

Good news: Half of your self-employment tax is a deduction in and of itself. If you recall, employers are permitted to write-off their portion of FICA (%). Or, you can deduct the expenses paid to operate and maintain your vehicle during the year, which include gas, oil, repairs, general maintenance, registration. But did you know you can deduct the “business portion” of those bills and write them off on your taxes? For example, if 50% of your phone use is for work, you. You can deduct the full expense if it's used all for your business. The deductions are not limited to half you self employment. You are. Generally, eligible self-employed people can deduct up to 20% of QBI from their business. QBI is the net amount of income, gain, deduction and loss from the. A self-employed individual may deduct 50 percent of his or her self-employment tax liability for the tax year. You can deduct the employer portion of your self-employment tax as an adjustment to income on Form The amount you can take as a tax deduction is usually. Personal expenditures are never tax deductible. I put this item first on this tax deduction checklist because sometimes the line can get blurred between. Security tax is not considered wages to the employee. Second, you can deduct half of your Social Security tax on IRS Form But the deduction must be taken. Security tax is not considered wages to the employee. Second, you can deduct half of your Social Security tax on IRS Form But the deduction must be taken. Self-employed individuals are entitled to a deduction of 50% of their self-employment tax on their individual income tax return. Self-employed individuals may. The good news is that the IRS considers the employer portion of the self-employment tax as a business expense, so you can deduct half of it. 3. Home office. Claiming these business deductions for self-employed workers can help you lower your tax bill. Write off these 12 overlooked tax deductions to save money. Self-employed individuals are responsible for paying both portions of the Social Security (%) and Medicare (%) taxes. Do I have to pay Self-Employment. A self-employed individual may deduct 50 percent of his or her self-employment tax liability for the tax year. Tuition, books, supplies, transportation and more may all be deductible if you're self-employed. The IRS provides a work-related education tool to help you. Enter the home office deduction: It's a powerful tax break exclusively for the self-employed. And it lets you write off a chunk of your living expenses. Who. Yes, though the amount of taxable income is figured slightly differently than for employees, because of the much greater range of allowed deductions. One of the. It may come as no surprise to you that filing taxes as an independent contractor isn't a cut-and-dry situation. For example, an independent contractor.

How Much To Build An Island In The Kitchen

How to Build a DIY Kitchen Island ; Make a Plan. A laptop featuring a woodworking design. ; Measure & Cut Lumber. A man sawing a wood board. ; Make Pocket Holes. A. Installing an island can enhance your kitchen in many ways, and with good planning, even smaller kitchens can benefit. I just did a kitchen island redo complete with ordering stools and the grand total was $7, Of course if you use cheaper materials and have. Build job winning estimates quickly This infographic highlights decisions and site issues that can cause large cost variances in the typical Kitchen Cabinet. The main kitchen renovation cost categories are cabinets, countertops, appliances, and labor. Key factors influencing the total cost include kitchen size, the. How to Do it Yourself: Build a custom island or peninsula using RTA cabinets. Ideas for building an island in your kitchen. Just looking at the images. There is a large cost range for kitchen islands. The national average is $4, to $8,, with most homeowners paying around $6, for a 24 prodat-mashinu-srochno.site semi-custom. Build the DIY Kitchen Island Case · Step 1: Cut the Boards · Step 2: Cut the Plywood · Step 3: Attach the Bottom to the Base Frame · Step 4: Cut the End Stiles. Purchasing or custom building a kitchen island costs between $3, and $5,, with less expensive models coming in at just $ and more expensive. How to Build a DIY Kitchen Island ; Make a Plan. A laptop featuring a woodworking design. ; Measure & Cut Lumber. A man sawing a wood board. ; Make Pocket Holes. A. Installing an island can enhance your kitchen in many ways, and with good planning, even smaller kitchens can benefit. I just did a kitchen island redo complete with ordering stools and the grand total was $7, Of course if you use cheaper materials and have. Build job winning estimates quickly This infographic highlights decisions and site issues that can cause large cost variances in the typical Kitchen Cabinet. The main kitchen renovation cost categories are cabinets, countertops, appliances, and labor. Key factors influencing the total cost include kitchen size, the. How to Do it Yourself: Build a custom island or peninsula using RTA cabinets. Ideas for building an island in your kitchen. Just looking at the images. There is a large cost range for kitchen islands. The national average is $4, to $8,, with most homeowners paying around $6, for a 24 prodat-mashinu-srochno.site semi-custom. Build the DIY Kitchen Island Case · Step 1: Cut the Boards · Step 2: Cut the Plywood · Step 3: Attach the Bottom to the Base Frame · Step 4: Cut the End Stiles. Purchasing or custom building a kitchen island costs between $3, and $5,, with less expensive models coming in at just $ and more expensive.

Higher quality, permanent kitchen island installations, including benchtops and sinks, are likely to start from around $10, Renovation specialist Dominic. Often, due to space constraints, you'll have to choose between the two. Our talented Laurysen team has designed and built countless kitchens to perfectly suit. DIY kitchen islands ideas for inspiration and cover the materials and steps you'll need to build your own kitchen island. Painting is an affordable option to transform the look of a kitchen island or kitchen cabinet in a dramatic way. Most of the time painting a kitchen island. The average cost to install a kitchen island is $ to $ A 24 square feet semi-custom island that people generally go for can cost you about $ The basic cost to Install Kitchen Base Cabinets is $ - $ per cabinet in August , but can vary significantly with site conditions and options. a kitchen island with the words how to build a kitchen island. More like this. budgetdumpster · Budget Dumpster®. 32k followers. Two Simple DIY Kitchen Island. Costly: The average cost for a custom-built kitchen island is between $3, and $5,, with the possibility of up to $10, for more complex and intricate. Harrell Design + Build can help! Talk With a Designer. One of the key decisions is whether your new kitchen layout will benefit best from an island. DESIGN-BUILD Finding the Kitchen Design Shape for Your Kitchen Island. There are so many solutions to finding the right spot for an island in your redesigned. Average kitchen island costs ; Island additions - sink, £, £, £ ; Create custom slimline island, £, £, £ This kitchen island is made from a surprisingly simple frame built around two stock cabinets, and can be sized to fit ANY base cabinets by changing only ONE. This easy to follow DIY Kitchen Island tutorial will teach you how to build a kitchen island in a few easy steps! Built out of stock cabinets from the home. Kitchen Islands ; $3, and $5,, but can go as little as ; $ or as much as ; $10, or more. Size, counter, cabinet material and features all play a role. Painting is an affordable option to transform the look of a kitchen island or kitchen cabinet in a dramatic way. Most of the time painting a kitchen island. Three IKEA kitchen base cabinets. 1 – 30″ wide cabinet; 2 – 24″ wide cabinets · 2x4s for island base & support wall · L-Brackets · 1/4” & 5/8” MDF · Decorative flat. Increase your food prep and storage space by using modular kitchen cabinets and pre-made countertops to create an island or a kitchen bar in your home. built kitchen island for your home, there are many facets to consider. Let's look at some important factors that play into island design. Then, we'll. Higher quality, permanent kitchen island installations, including benchtops and sinks, are likely to start from around $10, Renovation specialist Dominic. Three IKEA kitchen base cabinets. 1 – 30″ wide cabinet; 2 – 24″ wide cabinets · 2x4s for island base & support wall · L-Brackets · 1/4” & 5/8” MDF · Decorative flat.

Awd Sedans Under 25k

Subaru WRX. Limited Sedan. $19, · $3, below market. 45, miles ; Kia Amanti. Base Sedan. $1, · $1, below market. Used Vehicles $25, and Under for Sale in Altoona, PA · Honda Accord EX-L Sedan UJ · Honda HR-V EX 2WD SUV UJ · Honda CR-V Touring AWD. TrueCar has ranked the cheapest all wheel drive cars for August Research the top-performing vehicles on our list before heading to the dealership! There's something for everyone in the Lincoln MKZ. Oh, we forgot to mention — you can even get it with AWD added to any of those powertrains. We recommend going. AWD) | 25/27/26 mpg (T/AWD). Horsepower: hp. Engine: L Inline-4 Unlike the Mazda 3 Hatchback, the base sedan is available at under $25k. The. Searching for a Top-Rated Used Car for sale under $25,? Sunny King Honda has a great selection of cars, trucks, sedans, SUVs, and more to choose from. We. Sharp little car that performs pretty great and being from WI it actually drives pretty great on bad winter roads with the AWD on.. Used Sedans under $25, The Subaru Impreza is a compact sedan that provides plenty of room in both rows of seats and comes with outstanding safety scores. A used model in our bargain. Which are some good used AWD Sedans under 20k? 12, Views · Profile The list price is around $25k, so you should plan on. Subaru WRX. Limited Sedan. $19, · $3, below market. 45, miles ; Kia Amanti. Base Sedan. $1, · $1, below market. Used Vehicles $25, and Under for Sale in Altoona, PA · Honda Accord EX-L Sedan UJ · Honda HR-V EX 2WD SUV UJ · Honda CR-V Touring AWD. TrueCar has ranked the cheapest all wheel drive cars for August Research the top-performing vehicles on our list before heading to the dealership! There's something for everyone in the Lincoln MKZ. Oh, we forgot to mention — you can even get it with AWD added to any of those powertrains. We recommend going. AWD) | 25/27/26 mpg (T/AWD). Horsepower: hp. Engine: L Inline-4 Unlike the Mazda 3 Hatchback, the base sedan is available at under $25k. The. Searching for a Top-Rated Used Car for sale under $25,? Sunny King Honda has a great selection of cars, trucks, sedans, SUVs, and more to choose from. We. Sharp little car that performs pretty great and being from WI it actually drives pretty great on bad winter roads with the AWD on.. Used Sedans under $25, The Subaru Impreza is a compact sedan that provides plenty of room in both rows of seats and comes with outstanding safety scores. A used model in our bargain. Which are some good used AWD Sedans under 20k? 12, Views · Profile The list price is around $25k, so you should plan on.

BMW 4 Series i xDrive Coupe AWD · Kia Sorento EX AWD · Ford F Platinum SuperCrew 4WD · Ford Edge Limited AWD · Acura MDX AWD with. From compact sedans to spacious SUVs, we have a diverse inventory to suit Honda CR-V Special Edition AWD. Original Price. $27, Dealer. Discover pre-owned vehicles under $ at our used car dealership in Macon, GA. From stylish sedans to powerful SUVs, we have a versatile range of. Porsche Cayenne S AWD · Porsche Panamera 4 · INFINITI Q50 Premium AWD · Lexus IS Sedan RWD · INFINITI Q50 t Luxe AWD · Mazda. Used AWD Sports Cars Under $25, · Tesla Model 3 Long Range · Porsche Macan Base · Tesla Model X 60D · Audi S6 T quattro Premium Plus · Whether you're searching for a fuel-efficient sedan, a spacious SUV, or a versatile truck, our inventory has something for everyone, choose from all types of. Used Cars Under 25k · Why Buy Mazda Certified Pre-Owned · Sell Your Vehicle or From MAZDA AWD sedans to MAZDA AWD SUVs, you're sure to find exactly. Best Used Sedans With Automatic Emergency Braking (AEB) · Read All Rights Reserved. Some content provided by and under copyright by Autodata, Inc. Under 25k Miles · Sell Us Your Vehicle · Like-New At Liberty Toyota in Burlington, we have several Toyota SUVs and sedans with an all-wheel-drive system. $25K · Buying Out of State · Finance · Apply for Financing We've laid out everything you need to know about AWD sedans and SUVs in the Kia lineup, below. Used AWD Luxury Cars Under $25, · Genesis G70 T · Mazda CX-9 Grand Touring · Tesla Model Y Long Range · Tesla Model 3 Long Range · BMW. AWD (,). 4WD (,). RWD (77,). Unspecified () Sedan Engine: 4 Cyl L Transmission: Automatic. Description. Used and Certified Used for Sale in Niceville, FL · Pre-Owned Ford Explorer XLT · Pre-Owned Chevrolet Tahoe LT · Pre-Owned Honda Accord Sedan LX. From compact sedans to spacious SUVs, we have a diverse inventory to Honda HR-V Sport AWD CVT. Original Price. $28, Dealer Discount. Searching for a Top-Rated Used Car for sale under $25,? Sunny King Honda has a great selection of cars, trucks, sedans, SUVs, and more to choose from. We. Hybrid SE AWD shown in Ruby Flare Pearl. *. Step into a Toyota and drive Explore our lineup and discover all our cars under 25K. Start building your. $20,$25, close pill. Sedan close pill. Clear filters. Clear filters All wheel drive (AWD). Four wheel drive (4WD). Features & Technology. Backup. Kia Sorento LX AWD SUV. Next Photo Used Sedans and SUVs under $25, near Greencastle PA. Need a quality used. Here are a few of our most popular used vehicles that have made an appearance in our less than 25K collection. Audi A3 - The used Audi A3 is a luxury sedan. New Mazda Mazda3 Sedan Turbo Carbon Edition AWD SEDAN Zircon Sand Metallic for sale - only $ Under 25k · Under 30K Miles · Value Your Trade.

Trading Zone

Trading In The Zone - Elementary is one of the top share market learning courses, and it's absolutely FREE. trade directions may not be valid. Victoria also has as a more detailed trading zone map focusing on trading zones in northern Victoria. Additional zones. Trading in the Zone is an in-depth look at the challenges that we face when we take up the challenge of trading. To the novice, the only challenge appears to be. Trading in the Zone is a groundbreaking book written by Mark Douglas, which delves into the psychology of trading and offers valuable. In his book Trading in the Zone, Mark Douglas delivers eye-opening advice for overcoming the psychological barriers in simulated trading to achieve the desired. Master the market with confidence, discipline, and a winning attitude. A probabilistic mind-set pertaining to trading consists of five fundamental truths. SA TRADING ZONE, with its quality experience and perfect understanding of the market for 8 years, will be offering numerous and accurate services to our. The core of Douglas's theory is the idea of “the zone”. It alludes to a mindset in which traders perform at their peak, unhindered by fear. Trading in The Zone is not a technical analysis book and was designed for experienced traders trying to break though psychological struggles. It. Trading In The Zone - Elementary is one of the top share market learning courses, and it's absolutely FREE. trade directions may not be valid. Victoria also has as a more detailed trading zone map focusing on trading zones in northern Victoria. Additional zones. Trading in the Zone is an in-depth look at the challenges that we face when we take up the challenge of trading. To the novice, the only challenge appears to be. Trading in the Zone is a groundbreaking book written by Mark Douglas, which delves into the psychology of trading and offers valuable. In his book Trading in the Zone, Mark Douglas delivers eye-opening advice for overcoming the psychological barriers in simulated trading to achieve the desired. Master the market with confidence, discipline, and a winning attitude. A probabilistic mind-set pertaining to trading consists of five fundamental truths. SA TRADING ZONE, with its quality experience and perfect understanding of the market for 8 years, will be offering numerous and accurate services to our. The core of Douglas's theory is the idea of “the zone”. It alludes to a mindset in which traders perform at their peak, unhindered by fear. Trading in The Zone is not a technical analysis book and was designed for experienced traders trying to break though psychological struggles. It.

Published in , this book further expanded on the principles of trading psychology and explored the importance of cultivating a mindset that allows traders. What is the main focus of “Trading in the Zone”? The main focus of “Trading in the Zone” is on the psychological aspects of trading. Mark. The core of Douglas's theory is the idea of “the zone”. It alludes to a mindset in which traders perform at their peak, unhindered by fear. The Trading Zones Model was published in Trading Zones of Digital History on page This book will provide to those who choose to trade from a confident, disciplined, and consistent state of mind. Product Description:Dive into the mindset of a successful trader with Commas' "Trading in the Zone" canvas. A unique piece resembling the iconic book by. Trading In The Zone For Day Traders. Jonte. ·. Follow. 4 min read traders have virtually eliminated the effects of fear and recklessness from. Find many great new & used options and get the best deals for Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude by. What is the main focus of “Trading in the Zone”? The main focus of “Trading in the Zone” is on the psychological aspects of trading. Mark. Trading in the Zone introduces a whole new mental dimension to getting an edge on the market. Use it to leverage the power of the “zone” for. A trading zone can gradually become a new area of expertise, facilitated by interactional expertise and involving negotiations over boundary objects (objects. Douglas uncovers the underlying reasons for lack of consistency and helps traders overcome the ingrained mental habits that cost them money. Buy Pre-Owned Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude Paperback at prodat-mashinu-srochno.site Trading In The Zone For Day Traders. Jonte. ·. Follow. 4 min read traders have virtually eliminated the effects of fear and recklessness from. Brief summary. Trading in the Zone by Mark Douglas is a book that delves into the psychological aspects of trading and explores the importance of mindset in. Shop Trading in the Zone - by Mark Douglas (Hardcover) at Target. Choose from Same Day Delivery, Drive Up or Order Pickup. Free standard shipping with $ Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude Not rated yet! Availability Status: In stock at the Fulfilment. Master the market with confidence, discipline, and a winning attitude. A probabilistic mind-set pertaining to trading consists of five fundamental truths. Trading in the zone is a classic among trading books. Nevertheless, I found Douglas' book a complete dissapointment. Both books are a constant repetition of. Learn how to redefine your trading activities in such a way that you truly accept the risk, and you're no longer afraid.

Examples Of Roth Ira Investments

If you elect to contribute to an IRA, you must decide if you want utilize a Traditional or Roth IRA. Both are good options to save additional funds for. (m)(3)) are also permitted as Roth IRA investments. Page 28 For example, if you made a contribution to your Roth. IRA for , the five. Investing your IRA doesn't need to be difficult. Learn how to invest your Roth or traditional IRA in order to maximize your retirement savings. You have discretion on the timing of your contributions — For example, you don't have to fully fund the account when you open it. Once you make contributions. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. A Roth IRA can be an individual retirement account containing investments in For example, a contribution of the limit of $5, to a Roth IRA. Its broker-dealer subsidiary, Charles Schwab & Co. Inc. (Member SIPC), and its affiliates offer investment services and products. Its banking subsidiary. Its broker-dealer subsidiary, Charles Schwab & Co. Inc. (Member SIPC), and its affiliates offer investment services and products. Its banking subsidiary. Roth, traditional, and spousal are 3 common types of IRAs, which you can read more about below. See Roth and traditional IRA comparison. An outline of a. If you elect to contribute to an IRA, you must decide if you want utilize a Traditional or Roth IRA. Both are good options to save additional funds for. (m)(3)) are also permitted as Roth IRA investments. Page 28 For example, if you made a contribution to your Roth. IRA for , the five. Investing your IRA doesn't need to be difficult. Learn how to invest your Roth or traditional IRA in order to maximize your retirement savings. You have discretion on the timing of your contributions — For example, you don't have to fully fund the account when you open it. Once you make contributions. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. A Roth IRA can be an individual retirement account containing investments in For example, a contribution of the limit of $5, to a Roth IRA. Its broker-dealer subsidiary, Charles Schwab & Co. Inc. (Member SIPC), and its affiliates offer investment services and products. Its banking subsidiary. Its broker-dealer subsidiary, Charles Schwab & Co. Inc. (Member SIPC), and its affiliates offer investment services and products. Its banking subsidiary. Roth, traditional, and spousal are 3 common types of IRAs, which you can read more about below. See Roth and traditional IRA comparison. An outline of a.

A Roth IRA with Thrivent Mutual Funds is an individual retirement account to which you make contributions with money on which you've already paid taxes. You can contribute to a Roth IRA at any age if you have earned income (earnings from employment, including self-employment or alimony, not investment or rental. If, however, the tax rate is lower at the time of conversion versus the time funds are withdrawn from the Roth IRA, the conversion will be favorable. Example. Example: If you make $50, this year and put $5, in a traditional IRA, you pay taxes on an income of $45, But if you contribute $5, to a Roth IRA. bank or other financial institution; life insurance company; mutual fund; stockbroker. Types of IRAs. A traditional IRA is a tax-advantaged personal savings. With a traditional IRA, you delay paying any taxes until you withdraw funds from your account later in retirement. With a Roth IRA, you pay taxes upfront by. It's also helpful to know that with a Roth IRA, the rules do provide some flexibility to withdraw funds prior to retirement. For example, a Roth IRA allows. A Roth IRA with Thrivent Mutual Funds is an individual retirement account to which you make contributions with money on which you've already paid taxes. Transaction fees are charged each time you enter into a transaction, for example, when you buy a stock or mutual fund. In contrast, ongoing fees or expenses are. Yes, you can contribute to a traditional and/or Roth IRA even if you participate in an employer-sponsored retirement plan (including a SEP or SIMPLE IRA plan). This is an example of how personal contributions to a retirement account can provide tax savings under either pre- tax or a post-tax Roth Account. Contributes. IRAs and brokerage accounts both offer flexibility and control in terms of investment options. These include the ability to invest in stocks, bonds, mutual. IRAs and brokerage accounts both offer flexibility and control in terms of investment options. These include the ability to invest in stocks, bonds, mutual. For example, if you invest $1, in your Roth IRA in a certificate of deposit earning 2% per year, you'll earn $20 in interest that first year. If you. Funds that match up with investing goals and preferences ; Cash alternatives. Bank accounts aren't the only option · See cash alternatives ; Commodities. Broad. bank or other financial institution; life insurance company; mutual fund; stockbroker. Types of IRAs. A traditional IRA is a tax-advantaged personal savings. Roth IRAs hold a range of investments, with the largest share of Roth IRA assets invested in For example, on average, the sample of consistent Roth IRA. Investments in alternative assets can be made by Roth IRAs, SEP IRAs, SIMPLE IRAs, solo (k) o Example: IRA buys rental real estate for $, funded with. If you elect to contribute to an IRA, you must decide if you want utilize a Traditional or Roth IRA. Both are good options to save additional funds for. A Roth IRA with Thrivent Mutual Funds is an individual retirement account to which you make contributions with money on which you've already paid taxes.

Sunrun Price Prediction

SUNRUN INC has an Investment Rating of SELL; a target price of $; an Industry Subrating of Low; a Management Subrating of Low; a Safety Subrating. Sunrun Inc RUN forecast & targets · Sunrun Inc RUN share price forecast & targets for Intra Day are , , on the downside, and , , Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and. Sunrun is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is. Sunrun (NASDAQ:RUN) just reported results for the second quarter of NVIDIA (NVDA) Price Prediction. Sunrun Inc Stock (RUN) Price Forecast for Sunrun Inc Stock (RUN) is expected to reach an average price of $ in , with a high prediction of $ On average, Wall Street analysts predict that Sunrun's share price could reach $ by Aug 21, The average Sunrun stock price prediction forecasts a. Based on analysts offering 12 month price targets for RUN in the last 3 months. The average price target is $ with a high estimate of $38 and a low estimate. According to analysts, RUN price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a. SUNRUN INC has an Investment Rating of SELL; a target price of $; an Industry Subrating of Low; a Management Subrating of Low; a Safety Subrating. Sunrun Inc RUN forecast & targets · Sunrun Inc RUN share price forecast & targets for Intra Day are , , on the downside, and , , Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and. Sunrun is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is. Sunrun (NASDAQ:RUN) just reported results for the second quarter of NVIDIA (NVDA) Price Prediction. Sunrun Inc Stock (RUN) Price Forecast for Sunrun Inc Stock (RUN) is expected to reach an average price of $ in , with a high prediction of $ On average, Wall Street analysts predict that Sunrun's share price could reach $ by Aug 21, The average Sunrun stock price prediction forecasts a. Based on analysts offering 12 month price targets for RUN in the last 3 months. The average price target is $ with a high estimate of $38 and a low estimate. According to analysts, RUN price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a.

Sunrun Inc real time quote is equal to USD at , but your current investment may be devalued in the future. Current Price: USD. 7 Days. RUN's current price target is $ Learn why top analysts are making this stock forecast for Sunrun at MarketBeat. Sunrun Inc Price (RUN) Daily Price Prediction Charts. Sunrun Inc RUN forecast & targets · Sunrun Inc RUN share price forecast & targets for Intra Day are , , on the downside, and , , The 20 analysts with month price forecasts for Sunrun stock have an average target of , with a low estimate of 12 and a high estimate of The average. projections to be a reliable prediction of future events. Morgan Stanley compared the high and low price targets for Sunrun to construct the price target. Sunrun (NASDAQ:RUN) Stock, Analyst Ratings, Price Targets, Forecasts Sunrun Inc has a consensus price target of $ based on the ratings of 31 analysts. Sunrun Inc. Overview Solar / Technology · Lowering target price to $ · Sunrun Shifts Its Focus From Growth to Cash Generation With Storage-First Strategy. What is the forecast, or price target, for Sunrun (RUN) stock? A. Sunrun has a consensus price target of $ Q. What is the current price for Sunrun. Analyst Price Targets ; Low ; Average ; Current ; High. The average price target is $ with a high estimate of $38 and a low estimate of $ Sign in to your SmartPortfolio to see more analyst recommendations. View Sunrun Inc. RUN stock quote prices, financial information, real-time forecasts, and company news from CNN. Stock Price Targets ; High, $ ; Median, $ ; Low, $ ; Average, $ ; Current Price, $ This is calculated by using the average month stock price forecast for Sunrun Inc. The lowest target is $ and the highest is $ Please note analyst. Sunrun Inc's market capitalization is $ B by M shares outstanding. Is Sunrun stock a Buy, Sell or Hold? RUN / Sunrun Inc. (NasdaqGS) - Forecast, Price Target, Estimates, Predictions. Sunrun Inc. Tomorrow's Movement Prediction Forecast & share price targets for tomorrow -RUN Sunrun Inc. stock price movement predictions for tomorrow,weekly. Find the latest Sunrun Inc (RUN) stock forecast, month price target, predictions and analyst recommendations. Average Price Target ; High $ ; Average $ ; Low $ Sunrun is anticipated to decline in value after the next headline, with the price expected to drop to The average volatility of media hype impact on the.

Sofi Money Fdic Insured

money, make mobile deposits, and more via SoFi's website and mobile app. Any additional FDIC insurance is provided by the SoFi Insured Deposit Program. INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE. SoFi Bank, N.A. Member FDIC. SoFi Checking and Savings is offered through SoFi. SoFi Checking and Savings is a mobile-first online bank account that keeps your hard-earned dollars safe; all accounts receive FDIC insurance of up to $, No account fees · Unlimited transfers & free same-day withdrawals · No minimum or maximum balance to earn % APY · Up to $8M FDIC insurance through partner. Over time, the company expanded its offerings to include mortgages, personal loans, auto loans, credit cards, stock investing, insurance, estate planning and. All in one app to pay bills, deposit checks, send money, and more; FDIC insured up to $, Fees. Minimum balance: $0; Maintenance fee: $0; Overdraft fees. FDIC Cert #. ; Established. 12/29/ ; Bank Charter Class. National Banks, member of the Federal Reserve Systems (FRS) ; Primary Federal Regulator. We do the work in the background and you continue to access and manage all your funds from within your Primis banking app. Business Money Market Account Hero. Pay no account fees · Earn up to $ with direct deposit · Earn up to % APY · Access additional FDIC insurance up to $2M. money, make mobile deposits, and more via SoFi's website and mobile app. Any additional FDIC insurance is provided by the SoFi Insured Deposit Program. INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE. SoFi Bank, N.A. Member FDIC. SoFi Checking and Savings is offered through SoFi. SoFi Checking and Savings is a mobile-first online bank account that keeps your hard-earned dollars safe; all accounts receive FDIC insurance of up to $, No account fees · Unlimited transfers & free same-day withdrawals · No minimum or maximum balance to earn % APY · Up to $8M FDIC insurance through partner. Over time, the company expanded its offerings to include mortgages, personal loans, auto loans, credit cards, stock investing, insurance, estate planning and. All in one app to pay bills, deposit checks, send money, and more; FDIC insured up to $, Fees. Minimum balance: $0; Maintenance fee: $0; Overdraft fees. FDIC Cert #. ; Established. 12/29/ ; Bank Charter Class. National Banks, member of the Federal Reserve Systems (FRS) ; Primary Federal Regulator. We do the work in the background and you continue to access and manage all your funds from within your Primis banking app. Business Money Market Account Hero. Pay no account fees · Earn up to $ with direct deposit · Earn up to % APY · Access additional FDIC insurance up to $2M.

Deposit obligations of SoFi Bank are insured by the FDIC's Deposit Insurance Fund up to $, per depositor. SoFi Money cash management accounts) that are. FDIC Insurance: Up to $2 million in FDIC insurance through the SoFi Insured Deposit Program. Investment Accounts. SoFi also provides various investment. An FDIC-insured online checking account with no account fees and access to your deposits up to 2 days earlier. Learn more · SoFi High-Yield Savings Account. Up. These are sponsored offers rated highly by us for competitive rates, fees, and minimums. Learn more. Bank logo. Member FDIC. Checking Account. SoFi Bank is a member FDIC and does not provide more than $, of FDIC insurance per legal category of account ownership, as described in the FDIC's. If you tend to keep a lot of cash on hand, it could be worth looking into an account that offers more FDIC insurance than the $, limit. * SoFi members. People who don't meet these criteria earn an APY of just %—higher than the national average but not quite high yield. Is SoFi Bank FDIC-insured? Easy monthly cash rewards; $ Welcome Bonus; No hidden fees; No minimum balance required; Deposits are FDIC-insured. What Our Members Think. Don't just take. • FDIC insured to $, SMART INVESTING. • Stock and ETF I came back today in Sofi to add more money to my IRA and noticed that some. prodat-mashinu-srochno.site home page. About. About. The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the Congress to maintain stability and. FDIC Insurance does not immediately apply. Coverage begins when funds arrive at SoFi Bank, N.A. For more information on FDIC insurance coverage, please visit. Fees? No fees at all ; Security. FDIC insured, SSL/AES encryption and supports 2 factor authentication ; Customer service. Early morning, evening and weekend. FDIC-Insured - Backed by the full faith and credit of the U.S. Government. Golden Pacific Bank is now Golden Pacific Bank, a division of SoFi Bank, N.A. They are FDIC insured. So they aren't out any money if they give me back my money. They tell me I need to provide proof but won't tell me what proof I need to. FDIC insurance up to $2 million through the SoFi Insured Deposit Program Plus, with a bank account at SoFi, you can more quickly transfer money to and from. FDIC Insurance does not immediately apply. Coverage begins when funds arrive at a program bank. There are currently six banks available to accept these deposits. SoFi Checking and Savings is offered through SoFi Bank, N.A., Member FDIC. Cassidy Horton is a finance writer specializing in banking and insurance. SoFi Bank, N.A. is a Member FDIC. Annual Percentage Yield (APY). Members with direct deposit earn % APY on savings, no minimum balance needed. SoFi is insured by the Federal Deposit Insurance Corporation (FDIC), which insures deposits by up to $, per depositor per account. But with SoFi, you.

How Much Cost To Carpet A Room

The basic cost to Install Carpet is $ - $ per square foot in April , but can vary significantly with site conditions and options. The carpet quantity is calculated for an average room size of about square feet, with carpeting priced at $ per square foot. The quantity of carpet. We spent about $6k for square feet to be re-carpeted. We used Lowe's and had a good experience. The carpet we chose was on the cheaper side. Carpet Cost Calculator Example: Length = (x) Width = 12, Select Grade option: Builders Grade = $ Then "Calculate Cost" = sf/$ Enter the. room or a large repeated pattern, the waste factor can be much larger. Also do not forget about the carpet padding and tack strips. Carpet prices per square. For example, let's estimate flooring for a living room that is 12′ x 15′. You want to use carpeting that costs $54/sq yd and padding that costs $/sq yd. Carpet Calculator. Use our calculator to provide a general estimate on the amount of carpet you will need based on room sizes Please note that this. Select from a wide assortment of carpet to fit your room, lifestyle and budget. How much will my carpet installation project cost? Carpet type, padding and. The cost of carpet installation ranges from $ to $ per square foot, on average, for labor and materials. Below, we lay out how much it will cost to. The basic cost to Install Carpet is $ - $ per square foot in April , but can vary significantly with site conditions and options. The carpet quantity is calculated for an average room size of about square feet, with carpeting priced at $ per square foot. The quantity of carpet. We spent about $6k for square feet to be re-carpeted. We used Lowe's and had a good experience. The carpet we chose was on the cheaper side. Carpet Cost Calculator Example: Length = (x) Width = 12, Select Grade option: Builders Grade = $ Then "Calculate Cost" = sf/$ Enter the. room or a large repeated pattern, the waste factor can be much larger. Also do not forget about the carpet padding and tack strips. Carpet prices per square. For example, let's estimate flooring for a living room that is 12′ x 15′. You want to use carpeting that costs $54/sq yd and padding that costs $/sq yd. Carpet Calculator. Use our calculator to provide a general estimate on the amount of carpet you will need based on room sizes Please note that this. Select from a wide assortment of carpet to fit your room, lifestyle and budget. How much will my carpet installation project cost? Carpet type, padding and. The cost of carpet installation ranges from $ to $ per square foot, on average, for labor and materials. Below, we lay out how much it will cost to.

According to HomeAdvisor, the national average labor costs for carpet installation is “$ to $1 per square foot.” Combine that with the cost of your carpet. flooring material. how much material. floor installation process. Additional Expenses. precisely measuring and cutting carpet in new. Washington Carpet Installation Costs & Prices ; Cost of Carpet Installation in Washington. $ per square foot (mid-grade with padding) (Range: $ - $). Installing new carpet and not sure how much you need? Our Carpet Calculator Textured is the most popular living room carpet as it holds up to wear and tear. The average cost for carpet installation in the United States is typically in the range of $3 to $6 per square foot. Here's a rough estimate for. Homeowner Submitted Prices ; $, Mohawk (Patterned) ; Low cost carpet installation in every room of the house (except bathroom and kitchen). Smartstrand. New Jersey Carpet Installation Costs & Prices ; Cost of Carpet Installation in New Jersey. $ per square foot (mid-grade with padding) (Range: $ - $). How much does it cost to carpet a lounge room? Knowing how to price carpet installation for a lounge room can be tough! According to RemodelingExpense, the. Actual price will vary based on product selection and room configuration. Free Pad Upgrade applies to select items only. Free Carpet Install for carpet priced. I just had my carpet replaced in the lounge area including the 2 slide-outs. They also replaced the carpet on the steps going to the bedroom/bath area. The. How much does it cost to install carpet? According to HomeAdvisor, labor costs and materials can range from $ per square foot to $11 for carpet installation. Carpet Prices - Padding & Installation ; 9x12, $ ; 10x12, $ ; 12x12, $1, Determining an exact cost of carpet is a little tricky, but it can be done. Prices of carpeting can range anywhere between fifty cents to ten dollars per square. How much does it cost to install carpet? The typical cost to install carpet is roughly $3, While carpet installation often ranges in price from about. What is the cost to install carpet per square foot? With both labor and materials, the average cost to install carpet ranges from $ to $11 per square foot. The total cost to carpet three bedrooms measuring an average square-foot area runs from $1, to $5, Actual estimates vary based on room dimensions. The labor cost to install carpet ranges from $ to $ per square foot, with an average of $ per square foot. For a typical 10×12 room in Indianapolis. room. At first, the carpet pile might just look a bit flattened or a bit how much new carpet is going to cost. Unless you have unlimited funds, you. You have a lot of control here, as carpet can range from $20 per square metre or as much as $+ for top-quality; Carpet removal: If you're replacing carpet. What is the cost to install carpet per square foot? With both labor and materials, the average cost to install carpet ranges from $ to $11 per square foot.

Uncovered Call Option

The term “uncovered” simply means you're selling a call option contract that's not covered by a position in the underlying security. It's also known as a “naked. A covered call is a option strategy that combines stock ownership with selling call options. This tactic allows investors to potentially generate additional. In a covered call, the writer holds the underlying security. On the other hand, the writer does not hold any of the underlying security in an uncovered call. Uncovered options are where you are short the option but do not have an offsetting position in the underlying stock to "cover" your potential option obligation. On the other hand, in the case of a covered option call, the option writer selling the call options owns an equivalent amount of the underlying security. Though. For example, if someone sells a call option on a stock they do not own, and the stock price rises significantly, they would have to purchase the stock at the. An uncovered call is a short call option position where the writer does not own the specified number of shares specified by the option nor has deposited cash. A short call option position in which the writer does not own an equivalent position in the underlying security represented by his or her option contracts. See how call options and put options work, and the risks and rewards of options trading. The term “uncovered” simply means you're selling a call option contract that's not covered by a position in the underlying security. It's also known as a “naked. A covered call is a option strategy that combines stock ownership with selling call options. This tactic allows investors to potentially generate additional. In a covered call, the writer holds the underlying security. On the other hand, the writer does not hold any of the underlying security in an uncovered call. Uncovered options are where you are short the option but do not have an offsetting position in the underlying stock to "cover" your potential option obligation. On the other hand, in the case of a covered option call, the option writer selling the call options owns an equivalent amount of the underlying security. Though. For example, if someone sells a call option on a stock they do not own, and the stock price rises significantly, they would have to purchase the stock at the. An uncovered call is a short call option position where the writer does not own the specified number of shares specified by the option nor has deposited cash. A short call option position in which the writer does not own an equivalent position in the underlying security represented by his or her option contracts. See how call options and put options work, and the risks and rewards of options trading.

A short call (AKA naked call/uncovered call) is a bearish-outlook advanced option strategy obligating you to sell stock at the strike price if the option is. Yes, this is one of the ways to protect your uncovered call option. However, when you choose to buy the underlying stock, you have built a. An investor who writes a call option without owning the underlying stock is banking on a flat to bearish short-term forecast for the stock. The strategy. A naked call is a type of option strategy where an investor writes (sells) a call option without the security of owning the underlying stock. What draws investors to the covered call options strategy? A covered call gives someone else the right to purchase stock shares you already own (hence "covered"). Strategy. Margin Required at Time of Purchase ; Long (Buy) Call or Put. % of the option's premium. ; Covered Write (selling a call covered by long position, or. In the case of selling calls, I'm not sure what they do since the risk is unlimited. for example, if you sell 10 XYZ call options at $20 Strike. The writer of an uncovered put option bears a risk of loss if the value of the underlying instrument declines below the exercise price. Such loss could be. For example, a covered call position involves selling a call option against an existing long stock position. That means the investor/trader owns enough stock. As opposed to naked options, covered options are backed by an equivalent amount of the underlying asset. In other words, a trader selling a covered option. The term “uncovered” simply means you're selling a call option contract that's not covered by a position in the underlying security. It's also known as a “naked. Remember, the call is "covered" if you sell shares you already own but, if it's "uncovered," you must find shares to sell to the call purchaser. Options. Newbie to option trading here. Trading on paper trading with thinkorswim. It let me sell a PUT option on MFST the other day and filled the. A short call option position where the writer does not own the specified number of shares specified by the option nor has deposited cash. If your broker recommended an unsuitable uncovered option strategy that resulted in losses, you may have a case for recovery Call and speak to one of our. A short call option position in which the writer does not own shares of underlying stock represented by the option contracts. Uncovered calls are much riskier. An investor who writes a call option without owning the underlying stock is banking on a flat to bearish short-term forecast for the stock. The strategy. Summary. Selling an uncovered call is a bearish strategy that can benefit when the stock remains below the short call's strike price or falls. A covered call is a neutral to bullish strategy where a trader typically sells one out-of-the-money 1 (OTM) or at-the-money 2 (ATM) call option for every Naked Options vs. Covered Options · Naked Call. The buyer of a call option is aiming to profit from a rise in the price of the option's underlying security.

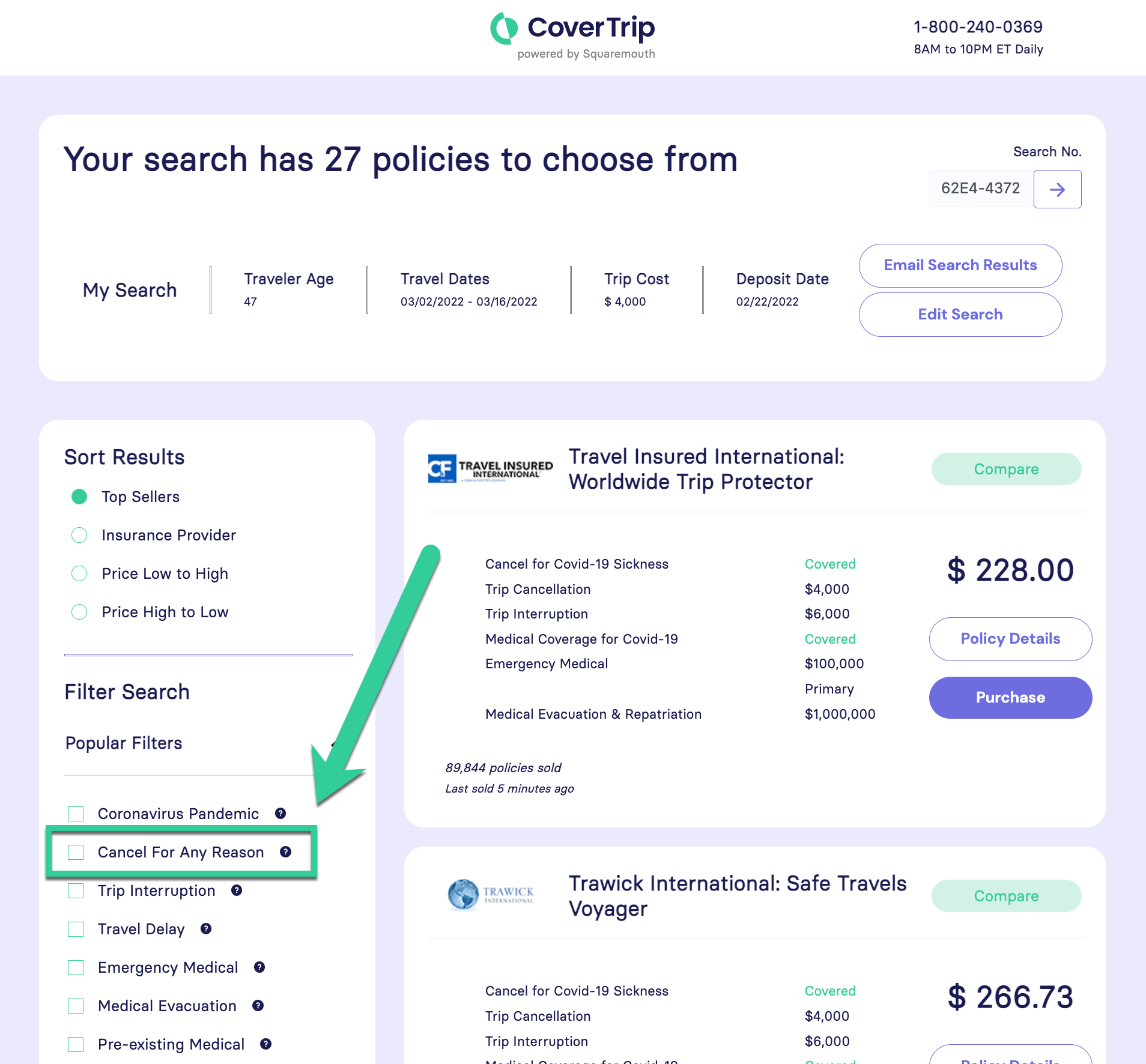

Travel Insurance Cancellation Cover For Any Reason

If you're already pregnant when you buy the travel insurance, trip cancellation usually isn't covered due to normal pregnancies. Cancel For Any Reason (CFAR) Insurance - Cancel For Any Reason coverage is a travel insurance benefit that allows you to get partially reimbursed for. Cancel for Any Reason (CFAR) is an optional travel insurance benefit that provides further cancellation coverage to travelers. See if it's right for you. From trip cancellations and medical emergencies to lost or delayed luggage, choose from Allianz' four different plans designed to cover your travel needs. 24/7. Coverage for prepaid travel and / or lodging expenses that are not recoverable if a covered trip is canceled due to serious illness or injury. Most cancel for any reason plans will reimburse you 50% to 75% of your prepaid, nonrefundable trip costs. When to purchase – You must purchase insurance. Cancel for Any Reason coverage, in addition to your traditional travel insurance, can cover up to 48 hours before your trip is scheduled to depart. Annual Multi-Trip Protector · Sickness or Injury tooltip · Death tooltip · Normal Pregnancy or Childbirth tooltip · Attending Childbirth tooltip · Mental, Nervous. Gain flexibility and more peace of mind with our CFAR option. Cancel for any reason, up to 48 hours before your departure. If you're already pregnant when you buy the travel insurance, trip cancellation usually isn't covered due to normal pregnancies. Cancel For Any Reason (CFAR) Insurance - Cancel For Any Reason coverage is a travel insurance benefit that allows you to get partially reimbursed for. Cancel for Any Reason (CFAR) is an optional travel insurance benefit that provides further cancellation coverage to travelers. See if it's right for you. From trip cancellations and medical emergencies to lost or delayed luggage, choose from Allianz' four different plans designed to cover your travel needs. 24/7. Coverage for prepaid travel and / or lodging expenses that are not recoverable if a covered trip is canceled due to serious illness or injury. Most cancel for any reason plans will reimburse you 50% to 75% of your prepaid, nonrefundable trip costs. When to purchase – You must purchase insurance. Cancel for Any Reason coverage, in addition to your traditional travel insurance, can cover up to 48 hours before your trip is scheduled to depart. Annual Multi-Trip Protector · Sickness or Injury tooltip · Death tooltip · Normal Pregnancy or Childbirth tooltip · Attending Childbirth tooltip · Mental, Nervous. Gain flexibility and more peace of mind with our CFAR option. Cancel for any reason, up to 48 hours before your departure.

Top Reasons Most People Cancel Trips · Injury or Illness. Sickness and injury are the top reasons for cancelling a trip. · Death. · Natural Disaster. · Acts of. Cancel for Any Reason If you are uncomfortable with the named reasons for which the trip cancellation coverage may be obtained, and you feel that you may have. Trip Cancellation and Trip Interruption · Select trip cancellation coverage amount based on your pre-booked trip expenses · Select either $, $1, or. Yes, travel insurance will typically cover you in case you get sick abroad. Some plans may exclude medical expenses incurred in places where a Level 4 Travel. AIG, Seven Corners and WorldTrips are Forbes Advisor's picks for the best "cancel for any reason" travel insurance. See our other top picks. That's why cancel for any reason coverage, or CFAR, can be a valuable add-on. With this type of policy, you can cancel your trip for any reason at all and still. Sometimes, travel doesn't go according to plan and that can mean you have to unexpectedly cancel your trip. In that situation, having trip cancellation. What is a covered reason for trip cancellation? · The unexpected death, sickness or injury of you, a travelling companion, or a family member. · Travel carrier. On some Travel Guard travel insurance plans there is the available option to add-on Cancel for Any Reason (CFAR) coverage – a separate benefit that gives you. Cancel For Any Reason (CFAR) Insurance - Cancel For Any Reason coverage is a travel insurance benefit that allows you to get partially reimbursed for. So, what reasons for canceling a trip are covered by insurance? · Injury or illness of insured, travel companion, family member, or business partner · Hurricane. Top-rated “cancel for any reason” travel insurance plans of ; Seven Corners. Seven Corners · Trip Protection Basic ; WorldTrips. WorldTrips · Atlas Journey. Cancel For Any Reason coverage is a travel insurance benefit that allows you to get partially reimbursed for cancelling a trip for a reason not otherwise. In case of a covered reason you are required to return home, Trip Interruption Insurance will reimburse you for the lost portion of your trip, as well as any. Fortunately, Trip Cancellation insurance can offer financial protection if you need to cancel your travel plans for a reason covered by your policy. Most best. “Cancel for any reason” travel insurance allows you to cancel your trip for any reason up to two days prior to your scheduled departure. · Depending on your plan. AXA Travel Protection trip cancellation coverage can offer reimbursement to travelers who are compelled to cancel their trips due to unforeseen events before. Cancel for Any Reason coverage offers travelers the most cancellation flexibility and is the only coverage option available to cover fear of travel. Trip Cancellation is a coverage included with your plan that's designed to make you "whole" again by reimbursing you up to % of your insured trip cost as. Adding Cancel For Any Reason insurance to your trip insurance means that you can cancel your trip for literally any reason and still be reimbursed for certain.